It’s very difficult to know when to buy an investment. No investor really wants to buy an investment when it’s at its highest price. So how can you help to protect against that from happening?

It’s called “dollar cost averaging.” This is a process where instead of contributing sporadically to an investment you view positively, while trying to time the market, the investor contributes regularly (weekly, bi-weekly or monthly) to this investment, essentially averaging the costs over time.

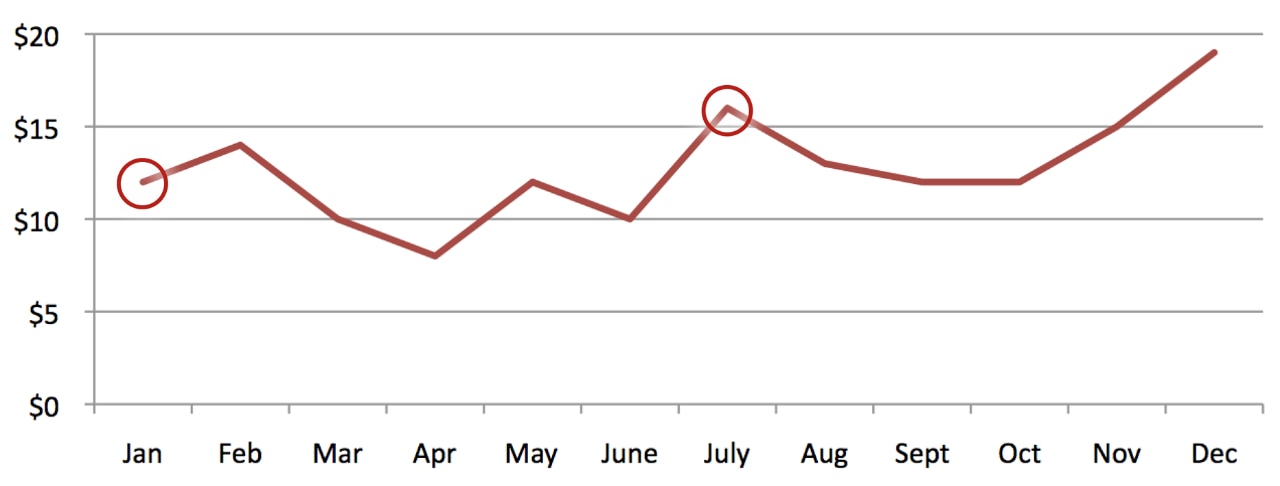

Let’s look at an example. Say there was a stock whose value changed randomly over time:

Cost of investment

Say you want to buy 120 shares of this stock. You decide to buy it in two installments – one in January, one in July. Given the fluctuating price of the stock, you end up spending $1,680:

| Month | Shares Bought | Price Per Share | Total Cost |

|---|---|---|---|

| January | 60 | $12 | $720 |

| July | 60 | $16 | $960 |

| Overall | 120 | $14 | $1,680 |

However, if you were to buy the same number of shares using dollar cost averaging – you invest the same dollar amount on a monthly basis in the security, – in this example you would get more shares for the same investment.

| Month | Shares Bought | Price Per Share | Total Cost |

|---|---|---|---|

| January | 20 | $12 | $240 |

| February | 17 | $14 | $240 |

| March | 24 | $10 | $240 |

| April | 30 | $8 | $240 |

| May | 20 | $12 | $240 |

| June | 24 | $10 | $240 |

| July | 15 | $16 | $240 |

| Overall | 150 | $11.19 | $1,680 |

Dollar cost averaging is a way of lowering risk by changing how you invest, not what you invest in. By spreading out your purchases evenly over time, you may reduce your chances of buying when the price is too high. In other words, when prices are high, you are buying fewer shares. It takes the guesswork out of the equation.

One way to take advantage of dollar cost averaging is by making sure you ‘pay yourself first’ – that is, having the contribution pre-authorized to be automatically withdrawn from your bank account on a regular basis. Then you’re not only taking advantage of dollar cost averaging – you’re also ensuring that your money goes to your investment goals rather than being spent on items that might be less important in the long run.

At Scotia iTRADE®, there are several ways to do this:

Set up a PAC, or Pre-Authorized Contribution plan.

Arranging a DRIP, or Dividend Reinvestment Plan to reinvest and dollar-cost average your dividends. Scotia iTRADE DRIPs charge no commissions, so your earnings are your own.

To set up a Pre-Authorized Contribution/Deposit download and fill out the form or to set-up a DRIP on your account see your Account Details page.

Don’t have a Scotia iTRADE account? Sign up today.

This publication has been prepared by Scotia Capital Inc. (“Scotia iTRADE”) and is intended as a general source of information and for educational purposes only and should not be considered as personal and/or specific financial, tax, pension, legal or investment advice. This publication does not take into account the specific personal, financial, legal or tax situation or particular needs of any specific person. No information contained in this publication constitutes a recommendation by Scotia iTRADE to buy, hold or sell any security, financial product or instrument discussed therein. The information contained in this publication neither is nor should be construed as an offer or a solicitation of an offer by Scotia iTRADE to buy or sell securities or to follow any particular investment strategy. Scotia iTRADE does not make any determination of your general investment needs and objectives, or provide advice or recommendations regarding the purchase or sale of any security, financial, legal, tax or accounting advice, or advice regarding the suitability or profitability of any particular investment or investment strategy. You will not solicit any such advice from Scotia iTRADE and in making investment decisions you will consult with and rely upon your own advisors regarding the appropriateness of implementing strategies before taking any action based upon the information contained in this publication. Opinions and projections contained in this publication are our own as of the date hereof and are subject to change without notice. While care and attention has been taken to ensure the accuracy and reliability of the material in this publication, neither Scotia iTRADE nor any of its affiliates make any representations or warranties, express or implied, as to the accuracy or completeness of such material and disclaim any liability resulting from any direct or consequential loss arising from any use of this publication or the information contained herein. This publication and all the information, opinions and conclusions contained herein are protected by copyright. This publication may not be reproduced in whole or in part without the prior express consent of Scotia iTRADE.