Ask the expert

Gain insights and knowledge from trading and investment pros.

Scotia iTRADE leads the way by working with respected industry leaders.

As a client, you can benefit from trading and investing education1 provided by our industry partners. Many have over 10 years of experience in financial services with areas of specialization that include ETFs, Fixed Income, Technical Analysis, Options and many more.

Thank you in advance for using Ask the Expert2, a new way to tap into the knowledge and experience of our team of industry experts.

Please note, our experts cannot answer questions regarding your personal portfolio, nor can they recommend any strategies or securities. Some examples of questions you may consider asking:

- What is the difference between an ETF and a mutual fund?

- How do interest rates affect bond performance?

- What is an Iron Condor?

Ask your question

Ask the expert frequently asked questions

Our experts can provide insight into a number of specialized inquiries you may have. Since we launched our program, several Scotia iTRADE clients have asked similar questions and we’re sharing our experts’ responses here. If your specific question is not addressed, please feel free to reach out and our experts will do their best to answer.

Accounts

ETFs

Fixed Income

Mutual Funds

Options

Preferred Shares

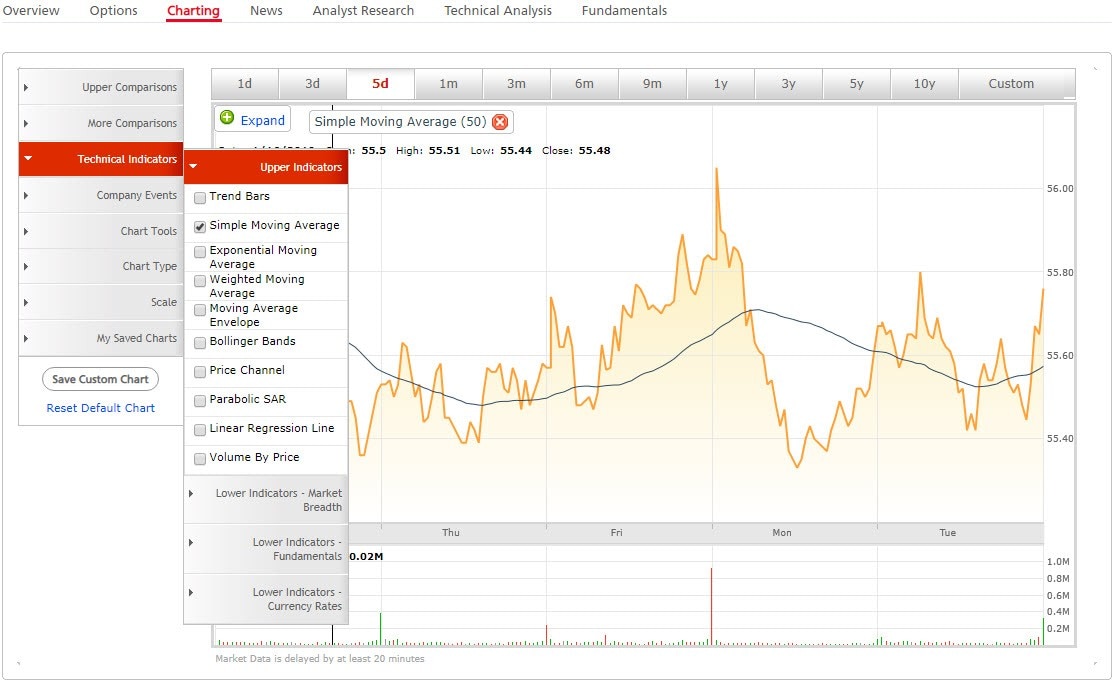

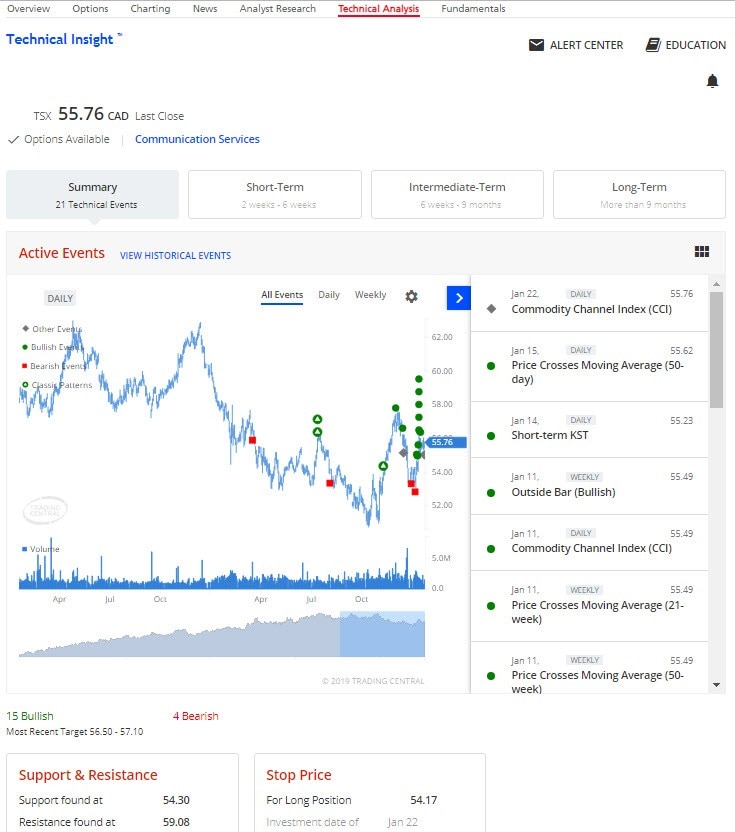

Technical Analysis

Trading

Industry experts by category:

Unless otherwise expressly stated by Scotia iTRADE®, seminars, webinars and other educational tools and resources (collectively, "Content") are provided by independent third parties that are not affiliated with Scotia Capital Inc. or any of its affiliates. Scotia Capital Inc. and its affiliates neither endorse or approve nor are liable for any third party, third party products or services, third party Content, or investment loss arising from any use of the Content, including third party Content. Content is for general information and educational purposes only, is not intended to provide personal investment advice and does not take into account the specific objectives, personal, financial, legal or tax situation, or particular needs of any specific person. No information contained in the Content constitutes a recommendation by Scotia Capital Inc. to buy, hold or sell any security, financial product or instrument discussed therein. The information contained in the Content neither is nor should be construed as an offer or a solicitation of an offer by Scotia Capital Inc. to buy or sell securities. Scotia iTRADE does not make any determination of your general investment needs and objectives, or provide advice or recommendations regarding the purchase or sale of any security, financial, legal, tax or accounting advice, or advice regarding the suitability or profitability of any particular investment or investment strategy. You will not solicit any such advice from Scotia iTRADE and in making investment decisions you will consult with and rely upon your own advisors and not Scotia iTRADE and will seek your own professional advice regarding the appropriateness of implementing strategies before taking action. Scotia iTRADE does not provide investment advice or recommendations and you are fully responsible for your own investment decisions and any profits or losses that may result. Any information, data, opinions, views, advice, recommendations or other content provided by any third party are solely those of such third party and not of Scotia Capital Inc. or its affiliates, and Scotia Capital Inc. accepts no liability in respect thereof. No endorsement or approval by Scotia Capital Inc. or any of its affiliates of any third party product, service, website or information is expressed or implied by any information or material contained in or referred to in the Content, on the Scotia iTRADE website or in any other Scotia iTRADE communication. Scotia iTRADE is a division of Scotia Capital Inc.

The information provided by the Industry Experts is provided by independent third parties that are not affiliated with Scotia Capital Inc. or any of its affiliates. No information shared or communicated to you by any of the Industry Experts constitutes a recommendation by Scotia iTRADE to buy, sell or hold any security, financial product or instrument referred to therein. No information shared or communicated to you by any Industry Expert is, or should be construed, as an offer, or a solicitation of an offer, to buy or sell securities by Scotia iTRADE. Scotia iTRADE does not make any determination of your general investment needs and objectives, or provide advice or recommendations regarding the purchase or sale of any security, financial, legal, tax or accounting advice, or advice regarding the suitability or profitability of any particular investment or investment strategy. You will not solicit any such advice from Scotia iTRADE and in making investment decisions; you will consult with and rely upon your own advisors and not Scotia iTRADE. You are fully responsible for any investment decisions that you make and any profits or losses that may result. Any information, data, opinions, views, advice or other content provided by any third party, including the Industry Experts (collectively the “Content”), are solely those of such third party and not of Scotia Capital Inc. or its affiliates, and Scotia Capital Inc. and its affiliates accept no liability in respect thereof. Neither Scotia Capital Inc. nor its affiliates accept any liability for any investment loss arising from any use of the Content. No endorsement or approval by Scotia Capital Inc. or any of its affiliates of any third party product, service, website or Content is expressed or implied by any information, material or content contained in, available through, included with, linked to or referred to in the Content, on the Scotia iTRADE website or in any other Scotia iTRADE communication. Scotia iTRADE is a division of Scotia Capital Inc.