Before you buy, invest a little time understanding mutual fund fees and sales charges.

You would never buy a home, a car or even a home entertainment system without researching your purchase beforehand. The same goes for your investment in mutual funds. It’s especially important to understand the costs and fees associated with the fund as they directly impact your returns.

Generally, there are two costs you want to be aware of before you invest: management expense ratio (MER) and load/sales charges.

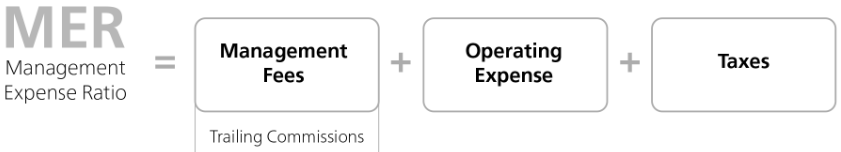

Management Expense Ratio (MER)

The MER is the total of the management fees, operating expenses and taxes, and is deducted from the fund’s annual return. Fees can vary greatly, so it’s smart to look into each fund’s MER, alongside performance projections.

Trailing commissions

A component of the management fee, the trailing commission is an ongoing annual fee, paid to the firm for which the fund advisor works, for the duration that you own the fund. The fee is viewed as an incentive for the advisor to review holdings and advise accordingly.

Loads or sales charges

A load or sales charge is a fee an investor pays when purchasing or redeeming shares from a mutual fund. This fee is separate from management fees, operating costs and taxes. Unlike MER, loads are deducted from the initial investment and paid to the advisor’s firm.

Depending on the funds and brokerages through which they’re purchased, loads may be applied differently. There are 3 types of loads:

Front-end load

This is a fee paid by the investor upon purchasing the mutual fund. The load is deducted from the initial investment and typically ranges between 0% and 5%. In certain cases, the load can be negotiated before you invest in the fund.

Back-end load

With a back-end load, the purchase fee is covered by the fund company who pays the advisor. You’re charged a redemption fee by the fund company when you decide to sell the fund.

There are two basic kinds of back-end loads:

Deferred Sales Charge (DSC):

Deferred sales charge are back-end loads in which the redemption diminishes to zero, typically over a term of six or more years.

Low-Load:

Low-loads have a similar structure to deferred sales charges. However, the redemption fee diminishes to zero over a shorter term. The typical term for low-loads is between two and three years.

No-load

No-load funds are funds in which no sales charge or redemption fee is charged to the investor. Scotia iTRADE offers only no-load mutual funds to our clients.

Mutual fund series

There are a multitude of different available series, each carrying a unique feature or characteristic. The most common and standardized series are A, D, F and I.

Fees for each series can differ significantly. To help ensure that the series you’re buying is the least expensive version of that particular fund, you’ll want to take time to review and compare fee structures.

Here’s a general comparison of the different series1:

Series |

Name |

General Description |

Key Details |

A |

Advisor |

Mutual funds offered by Financial Advisors and others. |

The management fees are usually higher to make up for the additional expense of the trailing commissions paid by the fund. |

D |

Discount |

Fund tailored to do-it-yourself investors, typically offered by direct investing brokerages |

Typically lower MER than series A |

F |

Fee-based |

Funds where fee structure is arranged with the advisor |

Negotiated fee structure |

I |

Institutional |

Funds aimed towards institutional and high net worth investors |

Minimum investment requirements |

Interested in investing in mutual funds?

Log onto Scotia OnLine, go to “Quotes & Research” and click on “Mutual Funds”. There you will find all the investing ideas on mutual funds.

Not a Scotia iTRADE client? Open an account today.

Although these are generally accepted as standard fund series, the details surrounding fee structure and requirements may differ among fund companies. For an absolute definition of a particular fund series always refer to the details and information provided by the fund company.

This publication has been prepared by Scotia Capital Inc. (“Scotia iTRADE”) and is intended as a general source of information and for educational purposes only and should not be considered as personal and/or specific financial, tax, pension, legal or investment advice. This publication does not take into account the specific personal, financial, legal or tax situation or particular needs of any specific person. No information contained in this publication constitutes a recommendation by Scotia iTRADE to buy, hold or sell any security, financial product or instrument discussed therein. The information contained in this publication neither is nor should be construed as an offer or a solicitation of an offer by Scotia iTRADE to buy or sell securities or to follow any particular investment strategy. Scotia iTRADE does not make any determination of your general investment needs and objectives, or provide advice or recommendations regarding the purchase or sale of any security, financial, legal, tax or accounting advice, or advice regarding the suitability or profitability of any particular investment or investment strategy. You will not solicit any such advice from Scotia iTRADE and in making investment decisions you will consult with and rely upon your own advisors regarding the appropriateness of implementing strategies before taking any action based upon the information contained in this publication. Opinions and projections contained in this publication are our own as of the date hereof and are subject to change without notice. While care and attention has been taken to ensure the accuracy and reliability of the material in this publication, neither Scotia iTRADE nor any of its affiliates make any representations or warranties, express or implied, as to the accuracy or completeness of such material and disclaim any liability resulting from any direct or consequential loss arising from any use of this publication or the information contained herein. This publication and all the information, opinions and conclusions contained herein are protected by copyright. This publication may not be reproduced in whole or in part without the prior express consent of Scotia iTRADE.